Search Results for

September 05, 2023

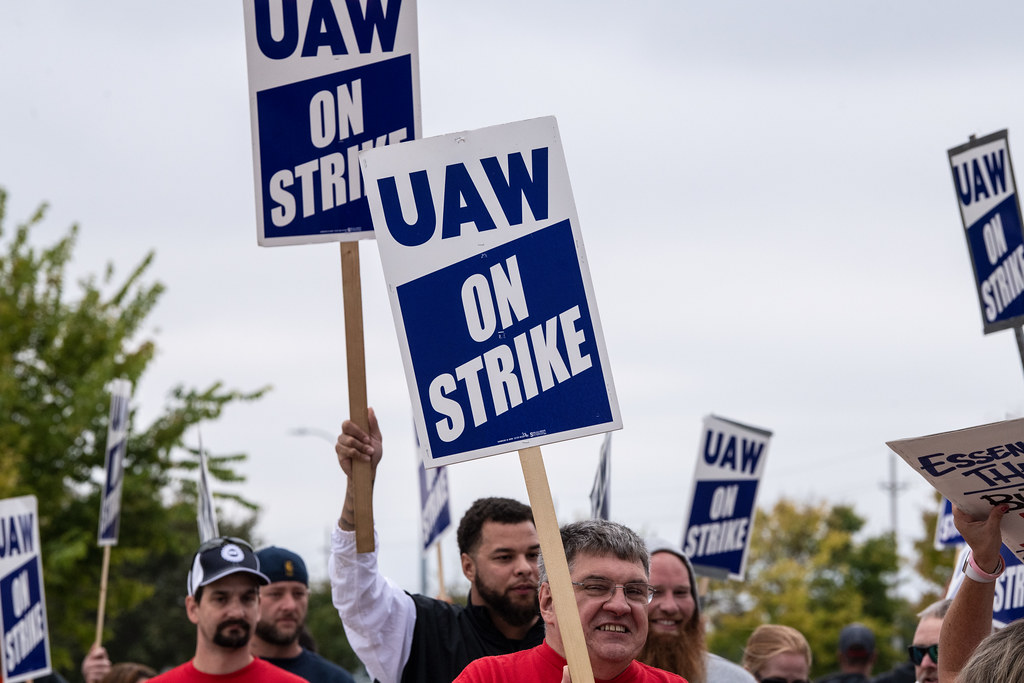

No, The "Union Boss" Is No Longer In The Mafia

I am asking you for the hundredth time, please stop using the phrase “union boss.” No one in your local unions is a mobster, I promise.

September 01, 2023

Big Pharma Sues To Keep Drug Prices Sky High

While the Inflation Reduction Act might be a new approach to drug prices, Big Pharma’s strategy of suing to keep prices high is a years-old strategy.

August 29, 2023

The Inaction Of The Obama Administration Got Us Here In Florida

A few days ago, a white supremacist murdered three innocent Black people at a Dollar General store in Jacksonville. Like the shooter in Buffalo and Dylann Roof in Charleston, he had a manifesto that espoused white nationalist talking points and conspiracy theories. The prevalence of racist attacks in recent years underscores the alarming rise of right-wing domestic terrorism in the United States. The problem I want to address is: Who at the highest levels of government is to blame for this?

August 29, 2023

Yet Another Reason To Ignore The Hacks At CRFB

Joe Biden has no interest in an Obama-style grand bargain to cut Social Security, but Republicans on Capitol Hill are still searching for neoliberal, ostensibly Democratic partners to force bipartisan cuts to the program. On Friday, August 18th, Senator Bill Cassidy (R-LA) took time out of his August recess to tweet “The 2020 election was not stolen, but Social Security is going insolvent. That is what we should be talking about.” A Republican senator advocating Social Security cuts is nothing new, but in a reply to his first tweet, Cassidy attempted to start a conversation within the Beltway by tagging more than a dozen “wonks,” wannabe wonks, and opinion columnists. Among them were two purportedly nonpartisan hacks known for their influence over moderate Democrats — Maya MacGuineas and Marc Goldwein of the Committee for a Responsible Federal Budget.

August 16, 2023

Louis DeJoy Is Not A Climate Ally

DeJoy remains the single biggest impediment to getting a fully electric and union-built postal fleet.

August 03, 2023

Blog Post BankingCampaign FinanceCongressional OversightConsumer ProtectionFinancial RegulationIndependent Agencies

Why Does Thom Tillis Love Junk Fees?

Because his corporate donors profit from them.

August 01, 2023

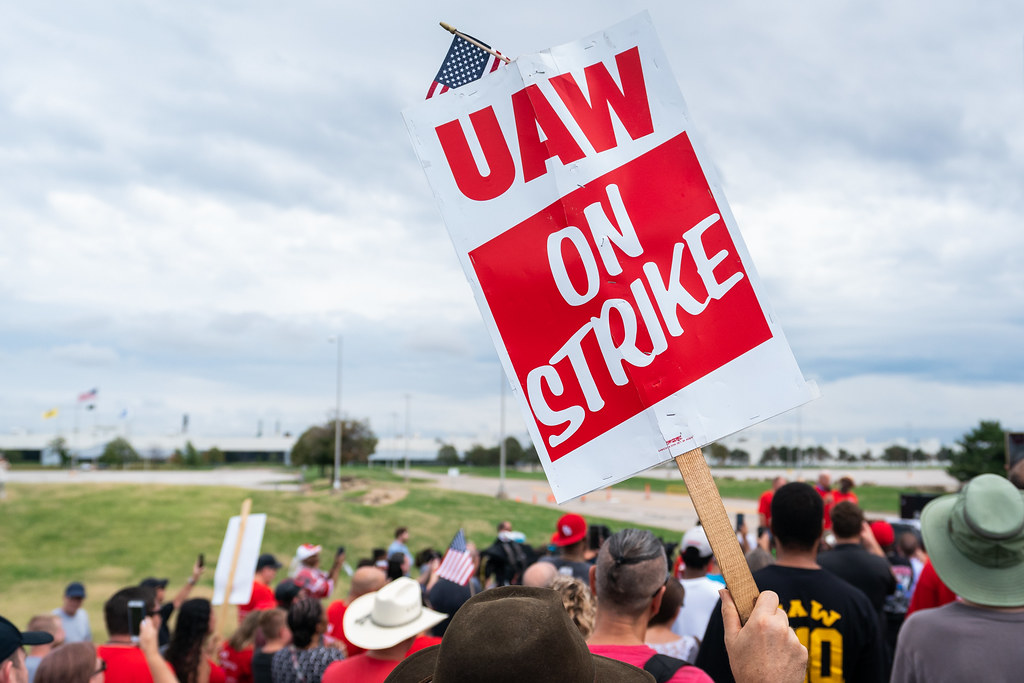

GM Exec. To White House: We Can't Be Held To Our Own Standards

Reuters reported Thursday on a recent meeting between the White House Office of Management and Budget officials and General Motors (GM) executive David Strickland. In the meeting, Strickland complained about proposals for updated vehicle emissions rules, which he argued could cost the industry from $100 to $300 billion dollars from 2027, when the rule would take effect, to 2031. Rather than acquiesce to the dire warnings of an economically interested party, the Biden administration did the right thing — it called Strickland’s numbers “pure speculation and inaccurate.”

July 21, 2023

Harlan Crow’s Minions Are Keeping Your Rent High

The National Multifamily Housing Council (NMHC) – a landlord lobby group led by Crow’s right-hand man – has spent millions to kill tenant protections and rent regulation.

July 18, 2023

Toni Aguilar Rosenthal Ananya Kalahasti

Blog Post Confirmations CrisisExecutive BranchIndependent Agencies

Independent Agency Spotlight Update: Summer 2023

This past spring gave us a slow rate of nominations from the White House and a similarly glacial pace of confirmations from a Senate that has been plagued with an utterly dysfunctional confirmations system.

July 17, 2023

Lina Khan Unscathed By Conflicted Ethics Officer and Pro-Monopoly Republicans

Rep Jim Jordan and company had already been eyeing Khan for an investigation because she had the audacity to enforce a consent decree that Twitter violated under Elon Musk’s leadership. Then, they eagerly seized on last month’s (conveniently timed) reporting from Bloomberg which published a previously unseen memo from an FTC ethics official and accused Chair Khan of ignoring the official’s recommendation. With that backdrop, the Republicans seemed poised to strike while the iron was hot, a culmination of their years-long project to undermine Khan’s leadership and reputation. The result was … much different. Thanks to some sleuthing on our part and the bipartisan support for taking on tech monopolies, yesterday’s hearing was less a damning inquisition and more a victory lap for Khan’s rejuvenation of the FTC.

July 11, 2023

Blog Post Consumer ProtectionFinancial RegulationIndependent AgenciesJudiciaryRevolving DoorSupreme Court

Trump’s CFPB Saboteurs Tell The Supreme Court To Finish The Job

Mick Mulvaney and Eric Blankenstein want to permanently cripple their former agency.

July 11, 2023

A Corporate-Led Trade Agenda Is the Wrong Path Forward

Yet despite these promises, email correspondence obtained through FOIA requests by Demand Progress show that senior officials across USTR, including Deputy U.S. Trade Representative Sarah Bianchi, actively seek input from executives at Big Tech firms such as Amazon and Google. Giving Big Tech a privileged ability to mold American trade policy undermines Biden’s commitment to a new era of trade deals.